January 2014

The next episode: can Dr. Dre’s Beats Music take on Spotify?

Beats Music is personable, but there’s a catch: unlike every one of its competitors, the service offers no ad-supported free model. If you want to jump in, you’ll have to pay $9.99 / month for its subscription service. Beats co-founder Dr. Dre and Beats Music CEO Ian Rogers have a very different idea for how streaming music should work, but does that mean the world’s hypiest headphones maker can stand up to the likes of Spotify, Rdio, and Pandora?

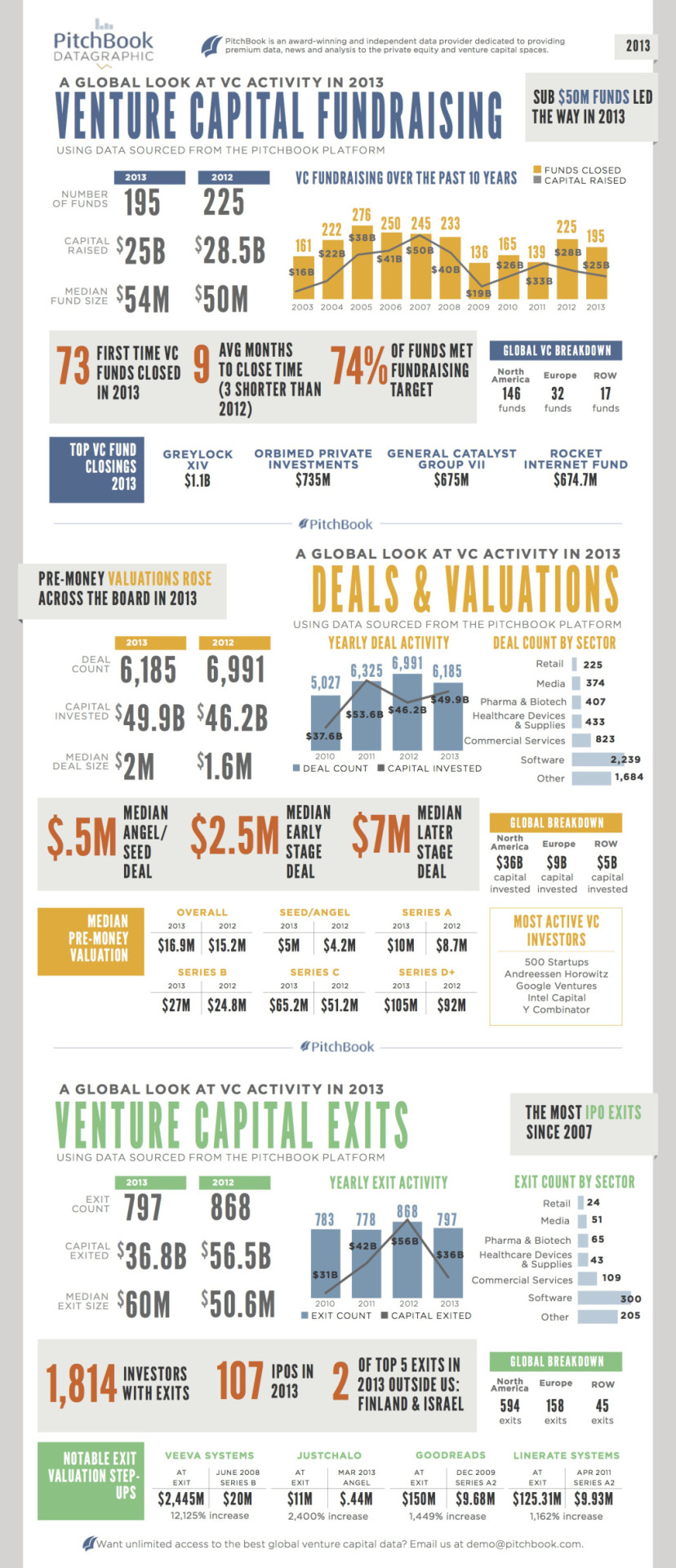

Venture-backed companies generated $56.5B in exits in 2013 (thanks to IPOs)

Venture-backed companies generated $56.5 billion in exits in 2013 from 868 deals. A total of 1,814 investors had exits.

Last year saw 107 IPO exits, which is the most since 2007, the year before the Great Recession. Merger-and-acquisition activity had its slowest year since 2009.

The amount invested in companies also went up in 2013, although the number of deals went down. VCs invested $49.9 billion of capital in 6,185 deals, as compared to $46.2 billion in 6,991 deals in 2012. Pre-money valuations and the median deal size increased across the board.

In 2013, 225 venture capital funds closed $28.5 billion. Funds closing less than $50 million led fundraising in 2013, and 73 first-time funds closed. Interestingly, the time spent fundraising dropped by three months.

The most active VC investors of the year were 500 Startups, Andreessen Horowitz, Intel Capital, and Y Combinator.